Market Value Exclusion for Veterans with a Disability

This market value exclusion program reduces the market value of the home for tax purposes, which may reduce your property tax. The program is administered by the counties.

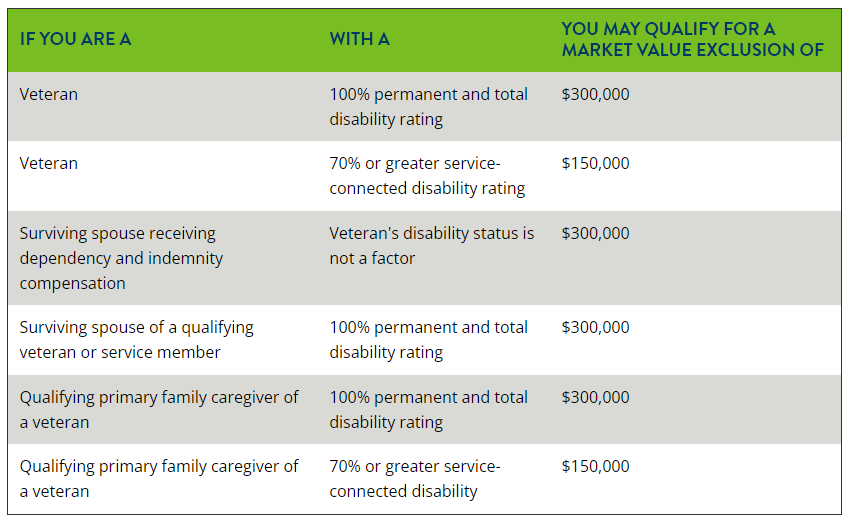

There are two exclusion levels, $150,000 and $300,000, depending on your status:

How to Apply

Apply to your County Assessor's Office by December 31 to qualify for taxes payable in the next year. Some manufactured homes are taxed in the same year their property is assessed. For these properties, apply as soon as possible. The property must already be receiving a homestead classification.

- Veterans must work with their veterans service officer to get their disability rating

- Surviving spouses must apply in order to continue receiving the exclusion